This ready to move property in Hitech City is readily available within an affordable cost of INR 4.50 Cr. This unfurnished flat is strategically designed with all the amenities to enhance the living experience. Hitech city and bio diversity park and just beside t hub are some of the well-known landmarks in this locality. With floating-rate home loans, the interest rate alters basis economic changes and RBI policy decisions. Choose this variant when you expect rates to reduce in the time to come.

HUD insures Title I loans with principals ranging up to $7,500. That’s enough to finance small to moderately sized home improvement projects, but not big-ticket remodels. In all cases, the home must be finished and occupied for at least 90 days afterward.

Home Loan Calculator

A home loan is secured in nature, i.e., the loan amount is sanctioned against a collateral, which is the property in question. Meet virtually any customer’s financial needs – With a wide variety of plans, you are armed with everything you need to help your customers get what they need or want. All you have to do now is wait till you reach 18 years old to apply and start your own business.

While not every home equity lender requires a full appraisal, all lenders need to determine the value of your home in order to calculate your available equity. If your lender doesn’t require a full appraisal, it might obtain these estimates by looking at county assessments, using automated valuation models or even driving by your home and taking photos. If you’ve had a full appraisal done within the last six months, the lender might also be able to use that information. Home equity is considered one of the most valuable assets a person can have.

Why should you choose Home Loan?

This is a loan paid out in a lump sum that you can repay over a number of years in regular fixed monthly payments. Before applying for a personal loan for home improvement, compare the best home improvement loan lenders for low interest rates, competitive fees, friendly repayment terms and quick payouts. A home equity loan allows you to borrow against the equity in your home and pay it back with a steady repayment schedule. A cash-out refinance lets you negotiate new mortgage terms and borrow funds for one-time expenses at the same time.

Rates and terms vary, but secured financing products generally carry lower financing charges than unsecured products. For a massive repair, such as a total roof replacement, the cost of higher premiums is not likely to exceed the repair’s out-of-pocket costs, even after the deductible. The calculation is different for modest repairs, claims on which could be swamped by long-term premium costs. A Title I Property Improvement Loan is a federally insured loan backed by the U.S.

Apply at your own pace.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Home equity loans and lines of credit can be great ways to fund major purchases. Find out what rates could be available for you with our rate and payment calculator.

It can be used to fund home improvements, although there are no rules that say cash-out funds must be used for this loan purpose. You can just as easily invest your cash, use it for debt consolidation, or put the lump sum into your bank account. If you don’t have the luxury of waiting to build up a home improvement savings fund, tackle home improvement projects over time as your cash flow allows.

How We Make Money

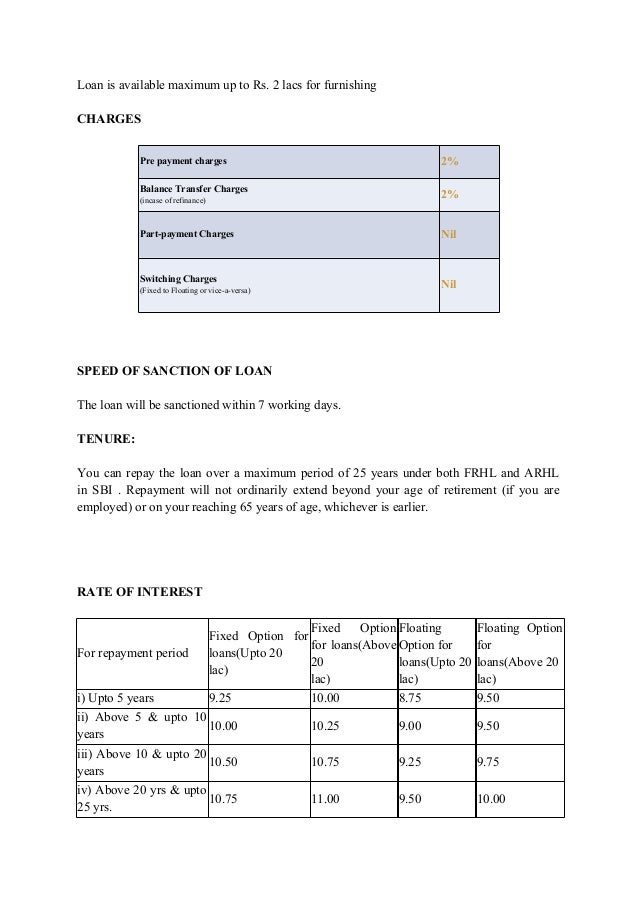

Additionally, the RBI mandates that you do not need to pay any prepayment or foreclosure charges if you’re an individual borrowing a floating rate home loan. You can also claim house loan tax deductions for registration fees and stamp duty charges under Section 80C. The loan amount is sanctioned at a predetermined interest for an agreed-to period, also known as the ‘tenor.’ The borrower repays the loan with interest through a home loan EMI, payable every month. The property ownership remains with the lender till the home loan repayment is complete, including interest.

Where ever attestation is not possible, this may be submitted duly notarized. Agreement of Sale/Sale Deed/Detailed cost estimate from Regd.Architect/Engineer for the property to be constructed. Construction/acquiring of new or existing house/flat and extension of existing house/flat. This option is only appropriate for “improvements” necessitated by insurance-covered events, such as storm damage.

Significant landmarks in its proximity are this project good view and very near to metro and malls. This exquisite 4 BHK Flat is offered for sale in Hitech City, Hyderabad. This apartment ready to move in the Hitech City is available for an attractive price of INR 6.20 Cr. This flat is an ideal choice because it is an unfurnished apartment with all basic amenities. Hitech City, Hyderabad has an attractive 4 BHK Flat for sale. Enjoying a prime location, this property is housed in the My Home Bhooja society.

If you cannot resolve the issue with the lender, file a complaint with the Consumer Financial Protection Bureau . LIHEAP funds may not be used to pay water and sewer bills. Utilities will come out to mark the area to help you avoid damaging or being injured by underground utility lines. The timing for processing your request differs from state to state.

There’s only one closing, so you’ll just have to pay closing costs once. If your income is too high to qualify for LIHEAP but you need help paying for your energy bills, your localsocial services agency or a nonprofit organization may have funds to help. You can also contact your gas, oil, or electric company about budget billing programs or new payment options especially for customers with disabilities who are on Supplemental Security Income . Borrowers with strong credit typically qualify for unsecured personal loans with affordable interest rates, low origination fees, and longer terms. The biggest credit-related risk of a home improvement loan is the risk of missing payments.

You can take professional help for creating a project report. Balance sheets show where money has been spent as well as what areas and fields it was spent in. Thus, this balance sheet will display all of the business’s accounts. It is critical to demonstrate your company’s balance sheets to the bank, and it should also be stated in the report. Finance is the lifeblood of every business, whether you’re starting up a new business or expanding an established company.

No comments:

Post a Comment